A rising consumption of entertainment content by Nigerians has led to the sector’s third straight quarter growth, with contribution to the economy reaching a high of N728.80 billion in the first quarter (Q1) of 2024.

This is an appreciable growth from N576.67 billion contribution recorded in Q1 of 2023 and N382.37 billion reported in the second quarter (Q2) of 2023.

According to data from the National Bureau of Statistics (NBS), this growth underscores the expansion of the Nigerian movie, music, arts, and entertainment industries, which have grown by 152.79 percent year-on-year over the past decade.

From a GDP contribution of N288.31 billion as of the first quarter of 2014, the arts, entertainment, recreation, motion pictures, sound recording, and music production industries grew to N728.80 billion as of Q1 of 2024.

The NBS aggregates numbers for the sector from revenue generated/total sales from the number of movies and sound recordings produced, including revenue generated from TV rights, royalties, and fees.

The sector, which is part of the broader services sector, has become a major contributor to the country’s overall GDP.

“The five top sectors are arts, entertainment and recreation, information and communication, construction, accommodation and food services and water supply, sewerage, waste management and remediation. Thus, Nigeria’s growth has been driven largely by the services sector during this period,” said Afolabi Olowoookere, managing director and chief economist, Analysts’ Data Services and Resources.

The country’s entertainment scene has benefitted from a boom in new content driven by increased investments, a growing cinema culture, and rising streaming services. The popularity of music genres like Afrobeats has also contributed to the boom.

According to Taiwo Kola-Ogunlade, Google communication and public relations manager in West Africa, Africa’s biggest export is content.

We just need to ensure that our creatives and storytellers are telling amazing stories,” Kola-Ogunlade said.

Temi Popoola, group managing director/chief executive officer of the Nigerian Exchange Group (NGX), highlighted the sector’s importance during a December event, stating, “Nollywood plays a critical role in selling the Nigerian economy…”

Nollywood’s financial success is attributed to box office revenue, home video sales, online streaming platforms, and international sales.

In 2023, Netflix disclosed that it had invested over $23 million in the Nigerian film industry over seven years, supporting 5,140 jobs and over 250 local licensed titles. This investment contributed $39 million to the Nigerian GDP, $34 million to household income, and $2.6 million to tax revenue, it said.

Cinemas in Nigeria generated N18.92 billion in revenue over the past three years, driven by a surge in ticket sales and box office hits between 2021 and 2023. Movies like ‘A Tribe of Judah’ have grossed over N1 billion at the box office, and others like ‘King of Boys’ and ‘Black Book’ have gone on to critical acclaim.

In 2023, cinemagoers spent N7.24 billion, up from N6.94 billion in 2022 and N4.74 billion in 2021.

According to FilmOne’s 2023 year-end box office figures, Nigerian cinemas were the highest-grossing in the anglophone West African region.

The growth of Nollywood, the second fastest-growing film sector globally, has spurred local investors to back creative talents. “The sky is the limit for Nollywood as long as investors continue to be the wind beneath her wings, propelling her stories, higher and higher,” said Kelvin Obasuyi, an Oxford alumnus and managing partner at 56 Capital.

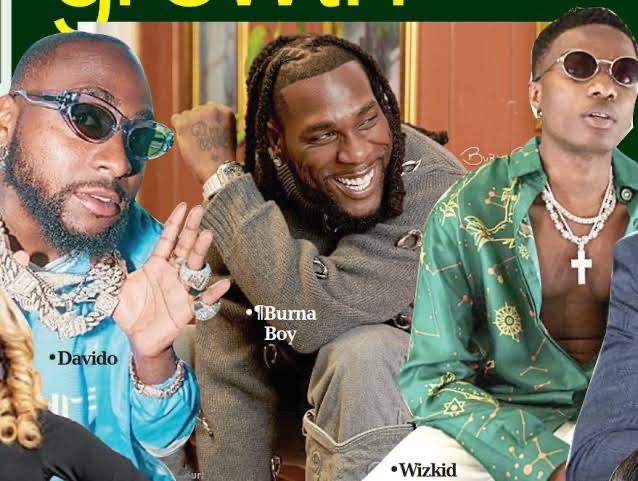

The country’s music industry is also thriving. According to Spotify Wrapped, local music demand surged 284 percent in 2023. Statista reported that the sector’s revenue grew from $26 million in 2014 to $34 million in 2018, with projections reaching $44 million in 2023.

A 2023 report by the International Federation of the Phonographic Industry revealed that music revenue in Nigeria and other Sub-Saharan African countries grew by 24.7 percent, driven by a surge in paid streaming revenues, which climbed 24.5 percent.

Bemigho Awala, a documentary filmmaker, attributed this growth to the global appeal of the Afrobeat genre and the international success of Nigerian artists and films. “The Afrobeat genre of Nigerian music has brought some sort of fear of missing out (FOMO) on the international circuits. Even as our artistes are selling out venues abroad, Nollywood films are doing interesting and humongous numbers locally in the cinema and on streaming platforms,” he said.

However, the sector’s growth is now threatened by economic headwinds in the country. In its financial report for the year ended March 2024, MultiChoice Group said, “…mass-market customers in countries like Nigeria had to prioritise basic necessities over entertainment…”

Despite this, the sector’s outlook remains positive, with players like Deola Art Alade, group chief executive officer, and Livespot360 continuing to drive growth.

PricewaterhouseCoopers (PwC), in its Global Entertainment and Media Outlook for 2022-2026, identified Nigeria’s media and entertainment industry as one of the fastest-growing creative industries in the world.

PwC projected an annual consumer growth rate of 8.8 percent for the sector and highlighted its potential to grow export earnings significantly, which it estimates will reach $1 billion soon.

Olaitan Ibrahim